Mastercard debit card integration

About company

My role

In the project, I worked as a product designer, where I handled various tasks including UI design, prototyping, user interviews, research, and usability testing. This role demanded adaptability, where I explored different aspects of product development.

Collaborated with founders, product managers, the marketing team, front-end, and back-end developers.

Why did we need to issue a card?

The company decided to attract small and medium enterprises, most of which required a payment card. We hadn’t issued either debit or credit cards.

Goal

We aimed to issue a debit card to 100 SMEs by the end of 2023. This initiative was driven by our commitment to improving finance management for our customers.

How did we determine we needed to issue a debit card?

The first indications regarding the need for debit cards came from the support team and the founders. I’m an advocate of conducting research before diving into development. I wondered how we could find out whether our customers actually wanted a payment card. Additionally, I wanted to determine what kind of problem they were trying to address by issuing a card.

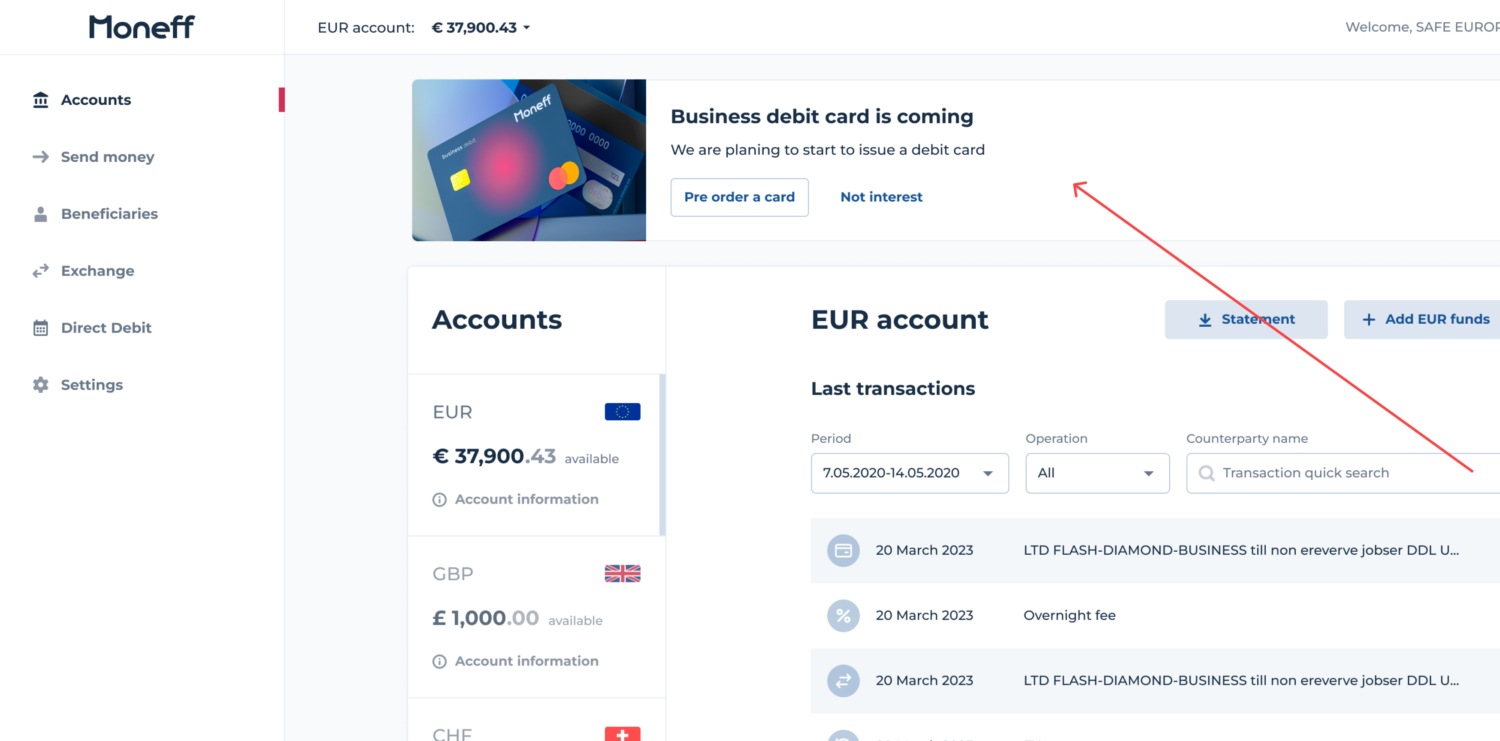

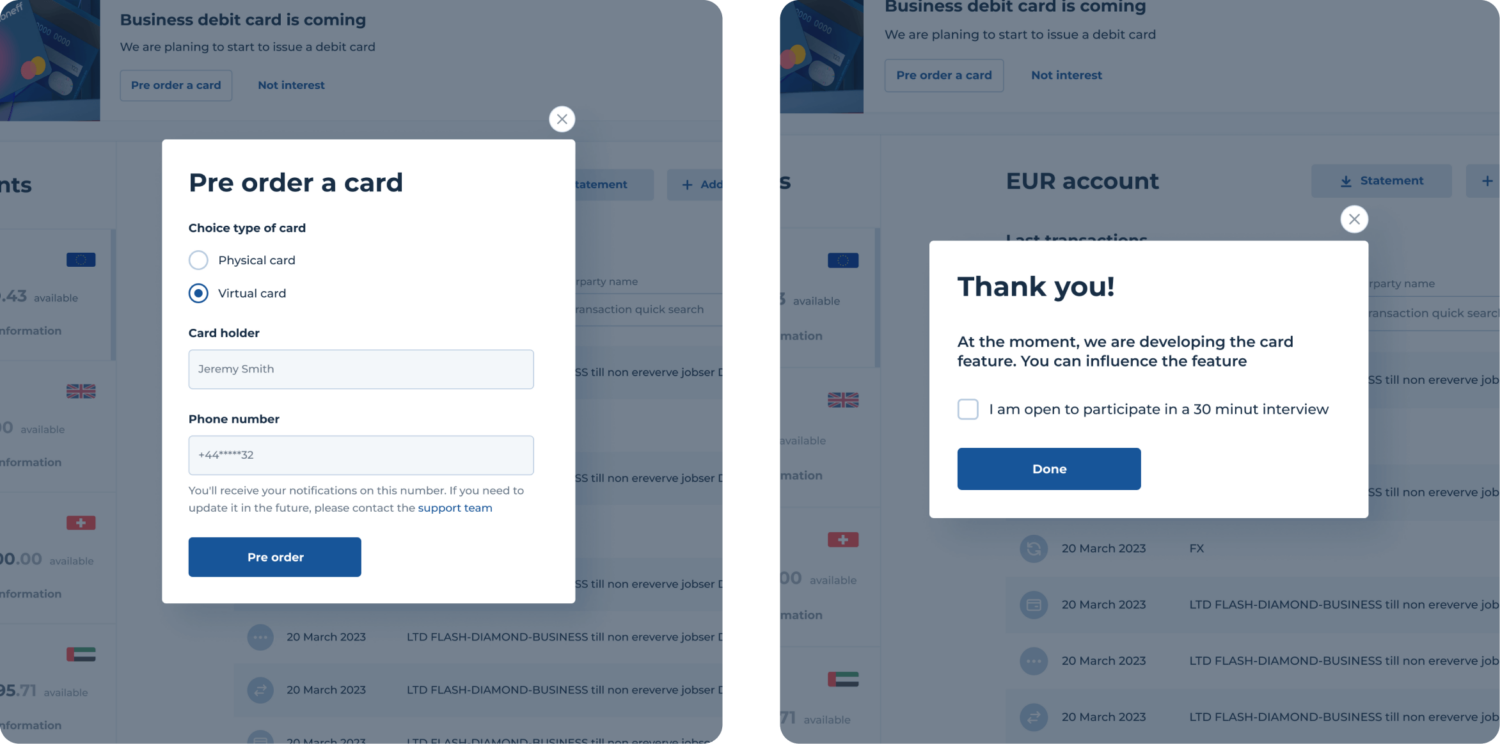

Fake door test methodology

This method was rejected because they didn’t want to mislead customers with false beliefs. Who knows, maybe we couldn’t release cards. Here is the prototype of the research.

Surveys

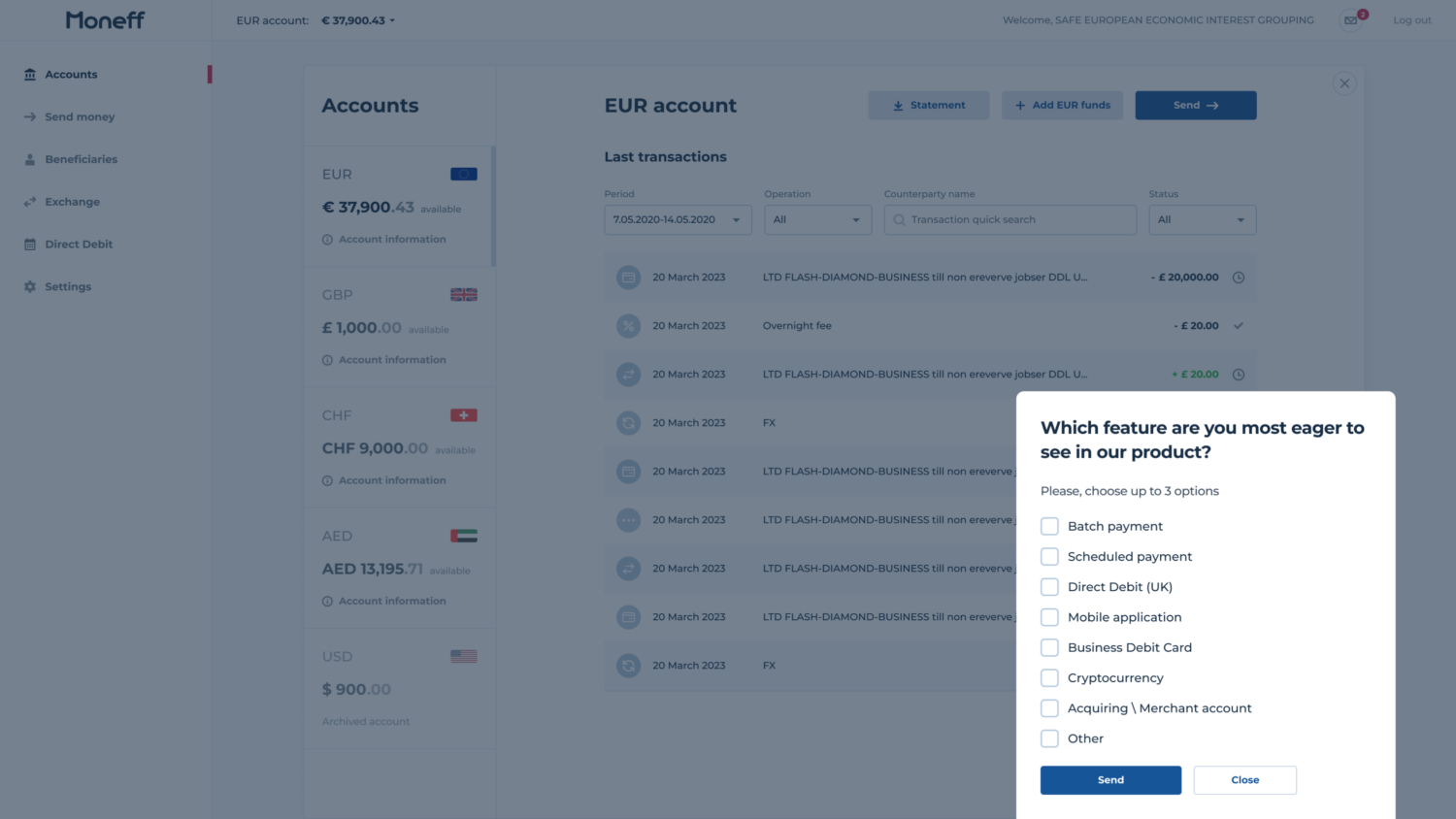

The idea was to assess customer demand for the card by integrating it into all features, allowing them to choose up to three options.

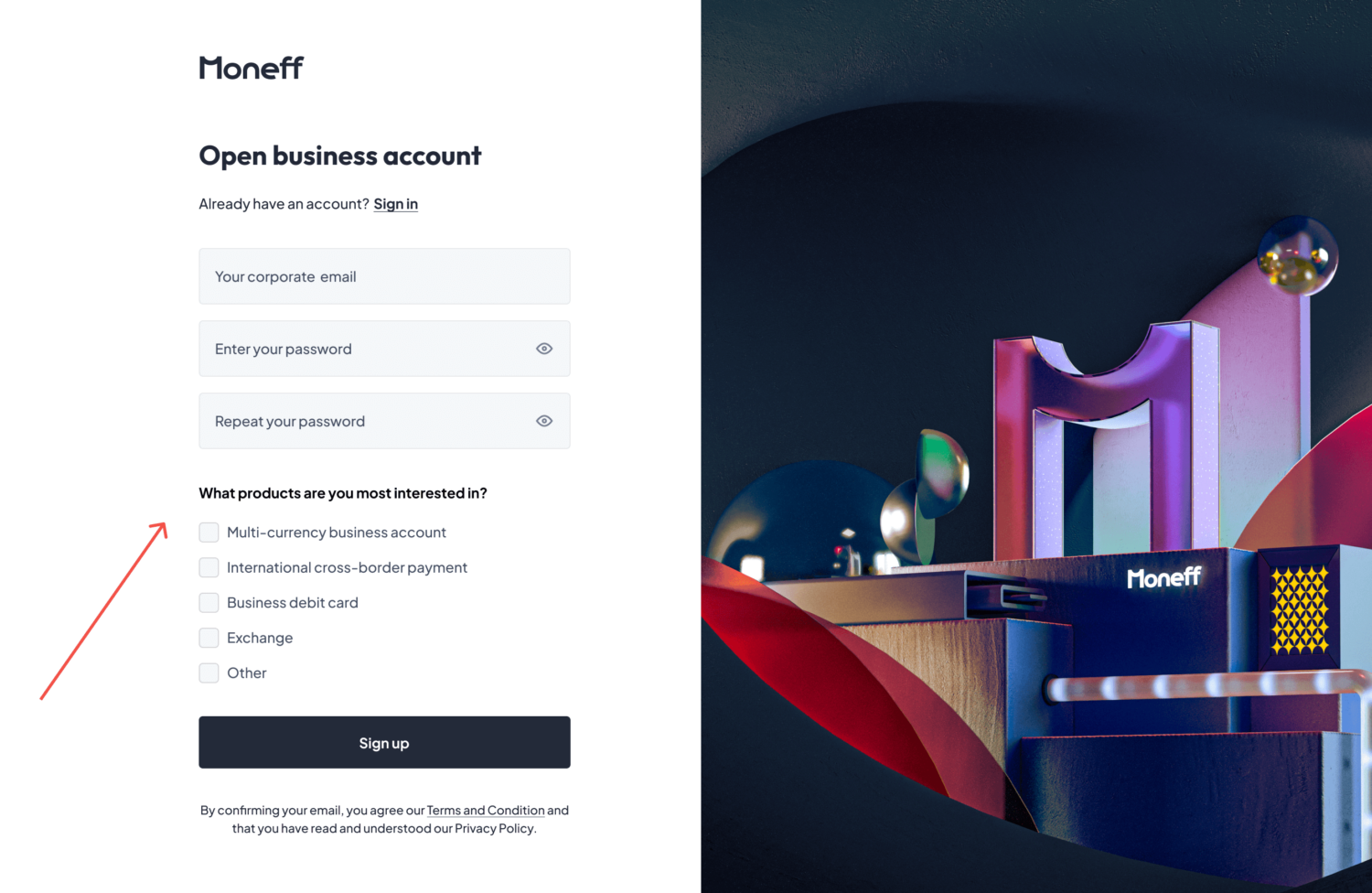

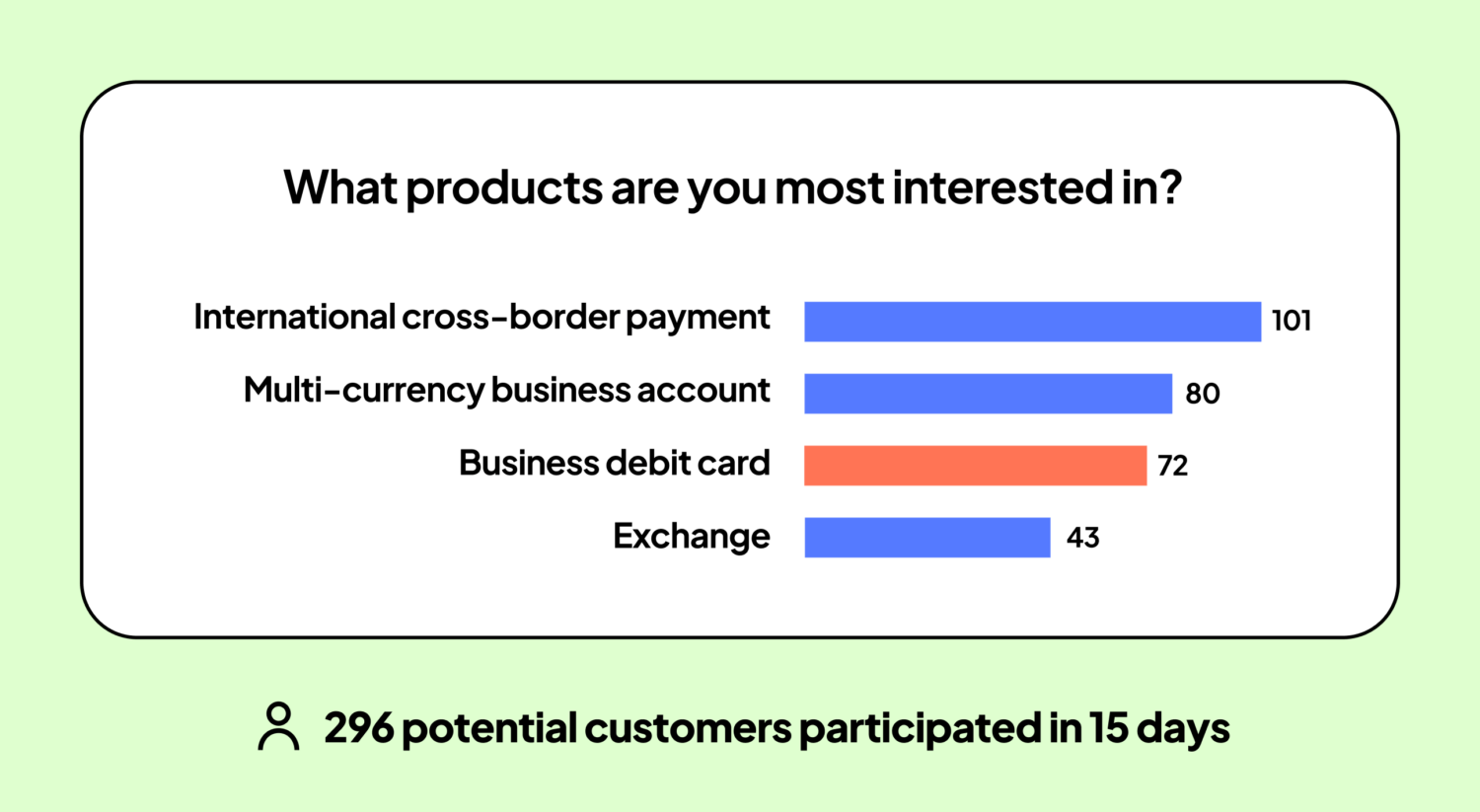

Survey with potential customers during sign-up

Survey within the product with Existing Customers

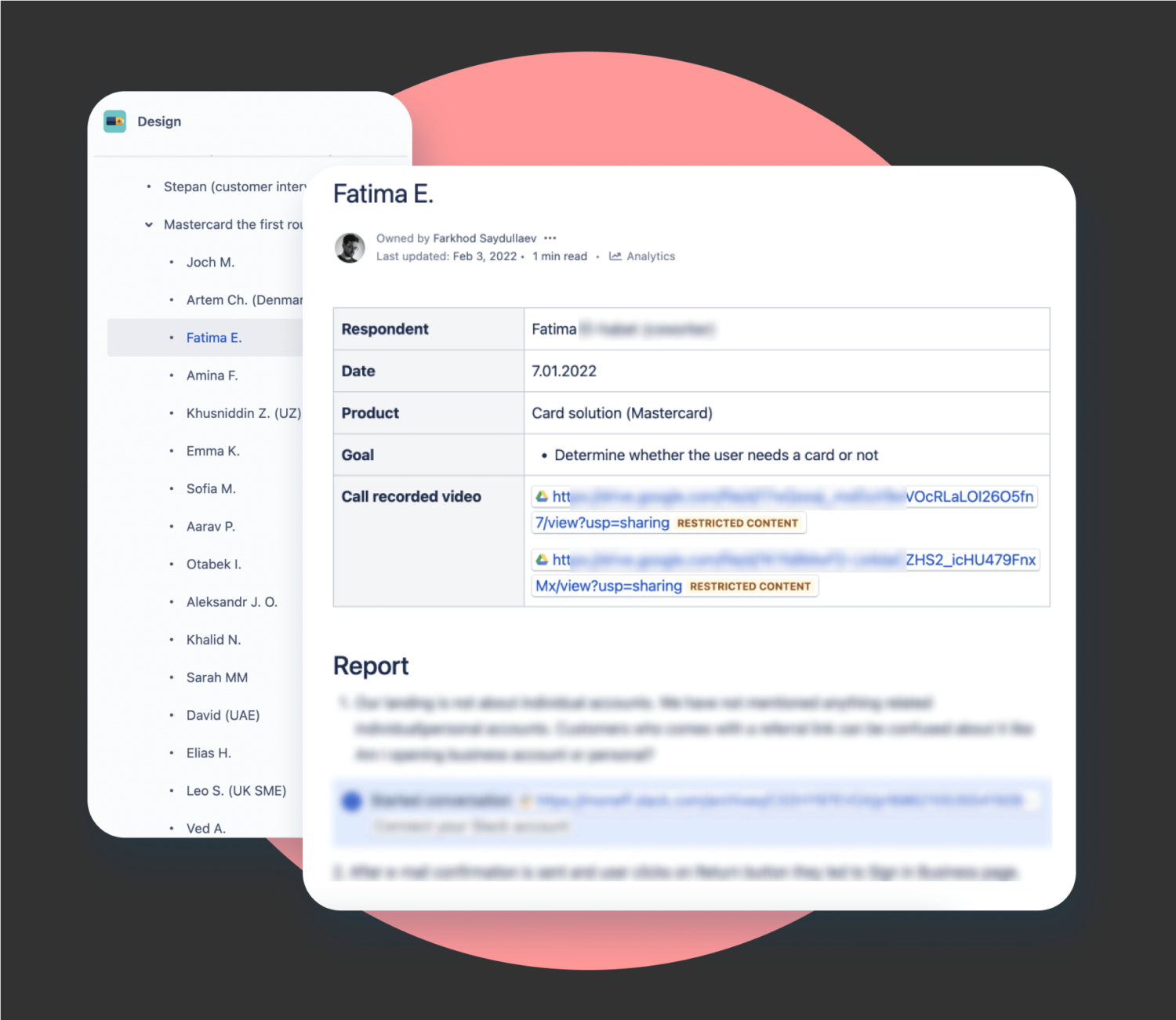

Interview with existing customers

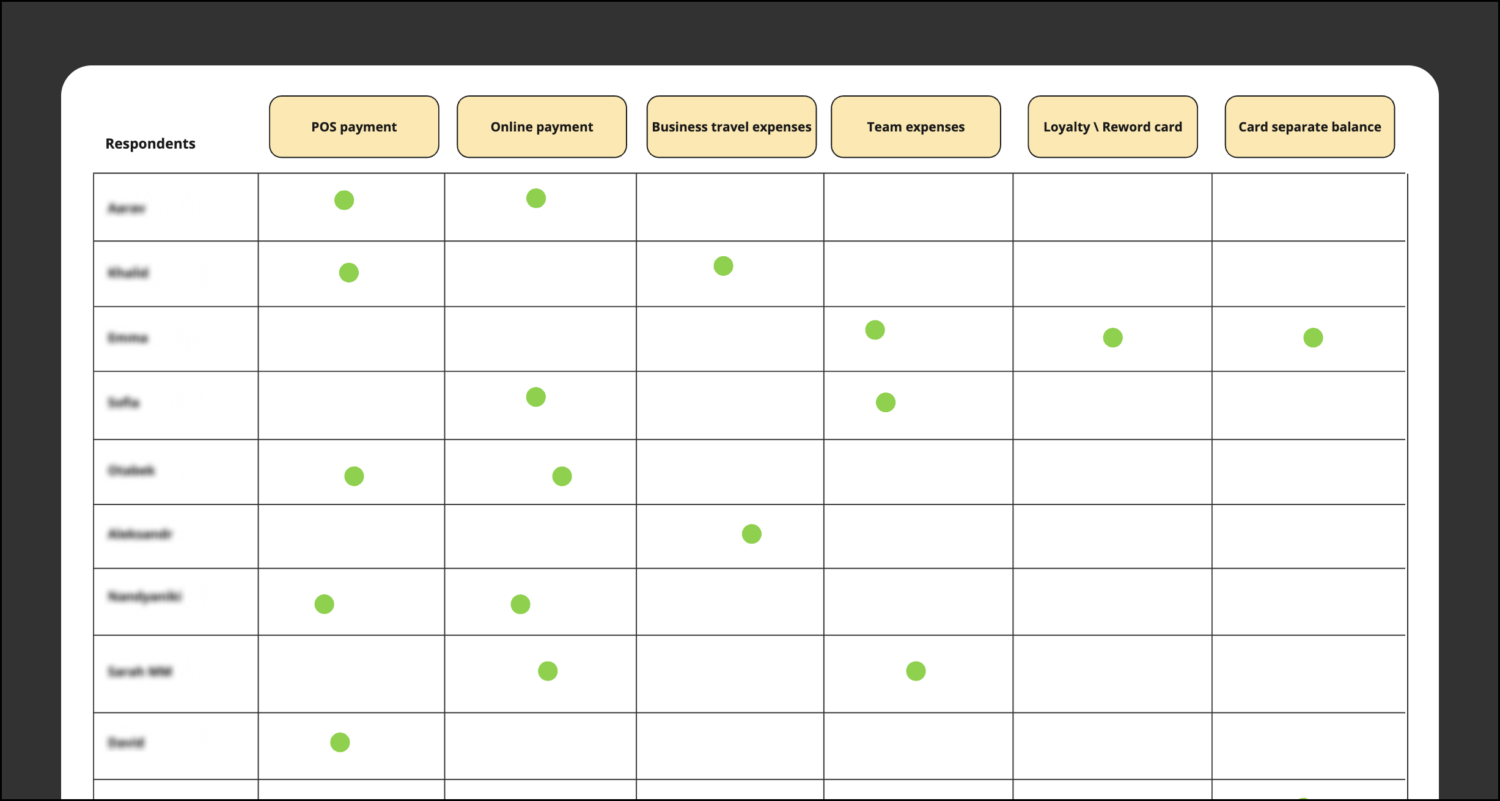

I conducted 19 moderated online interviews to determine whether our customers felt the need to have a card or not.

Here are some of the questions that were asked:

- Can you recall your most recent transaction using our service?

- Why do you choose to use our services?

- What is your payment process like?

- What did you use before our service?

- Are you currently using other services?

- Could you explain why you use those services?

I didn’t ask direct questions like ‘Do you need a card?’ because, as we know from studies, it is the worst question. Users often say one thing, but their intentions are different. I learned this from ‘The Mom Test‘ book.

What was found in the discovery step

- We waited until more than 50% of customers participated in the survey. It took around half a month.

- We ran the survey close to the end of the month when customers were more active.

- Just for reference, we don’t have many customers. We are a small B2B startup.

The survey results within potential customers during sign-up

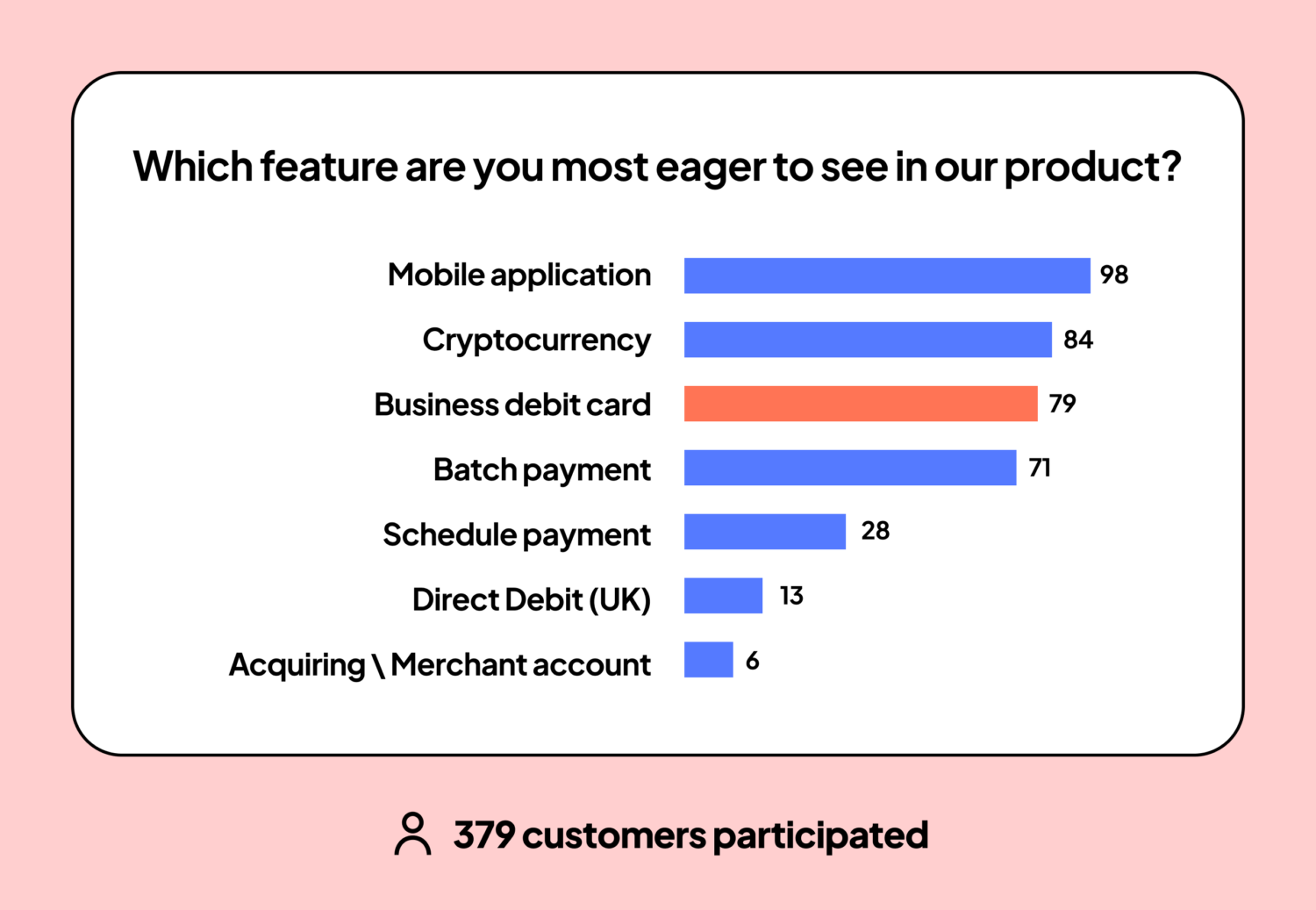

The survey results among existing customers

Analyzed interviews and sorted respondents’ demands on why they need a payment card

The research shows that our customers face issues with managing their money, and providing a card is a good option. Customers spending money = the business making money.

We found out users’ needs. Let’s draw design concepts

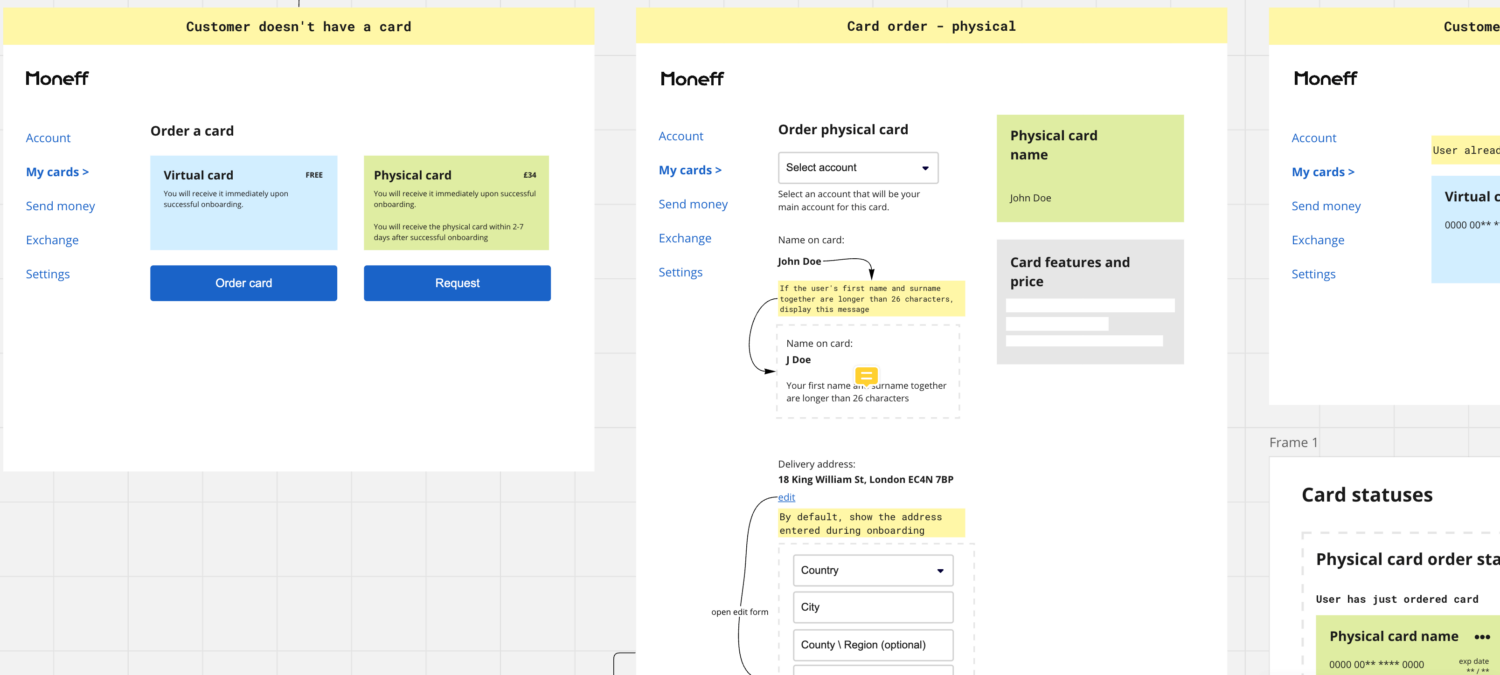

Low-fidelity wireframes

Built and tested a low-fidelity wireframe, identified issues, and resolved them in the high-fidelity design

References and competitors’ solutions

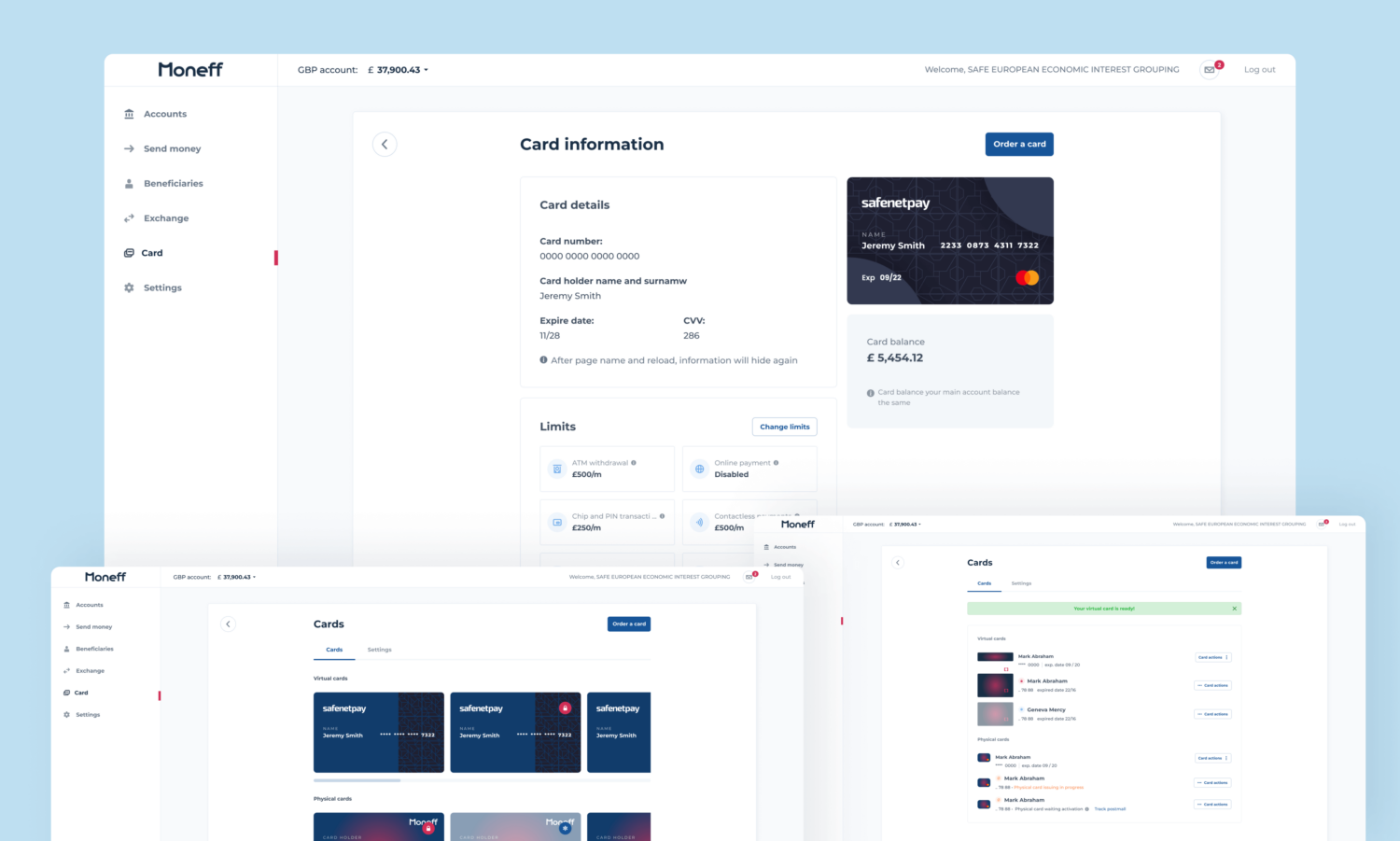

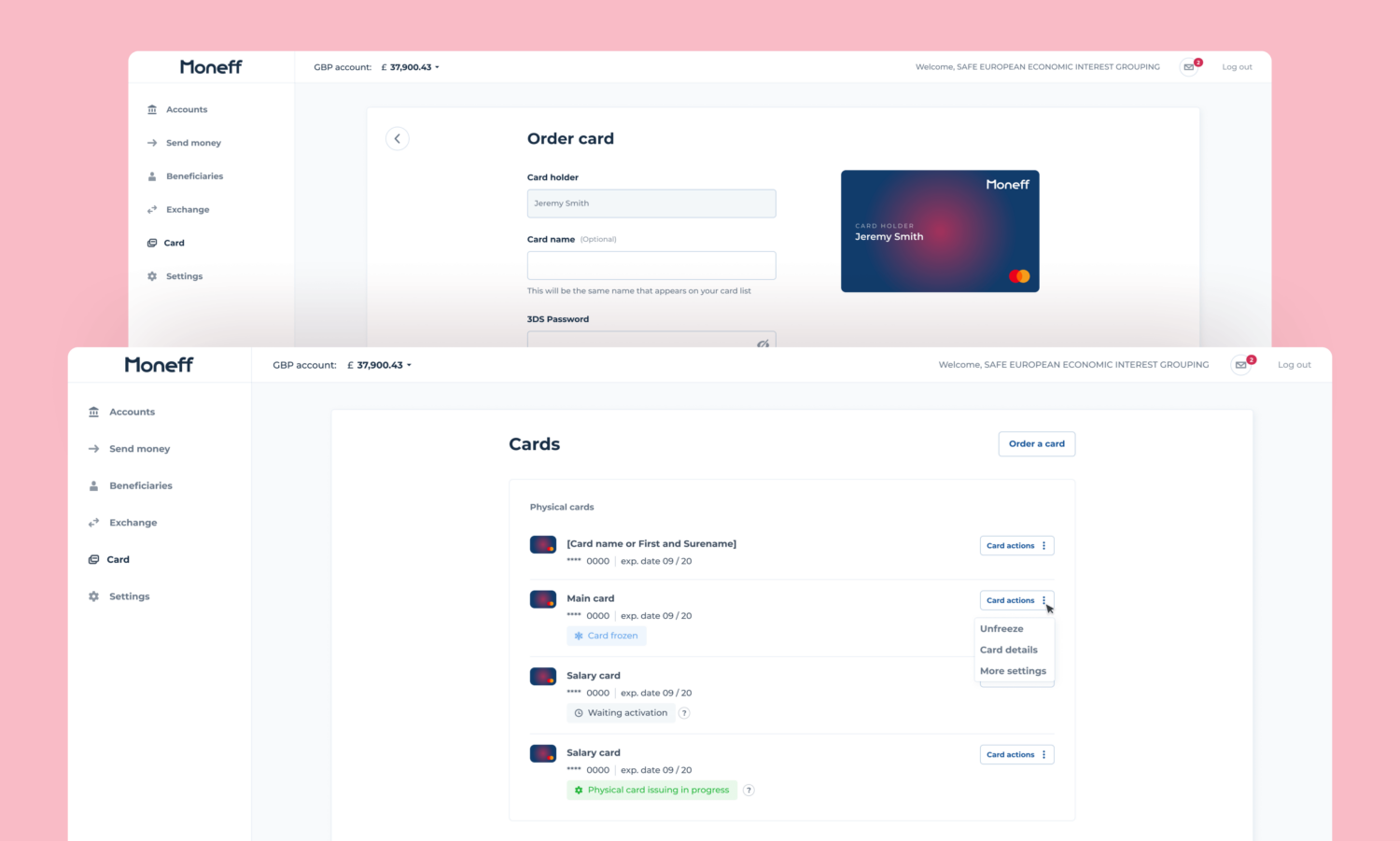

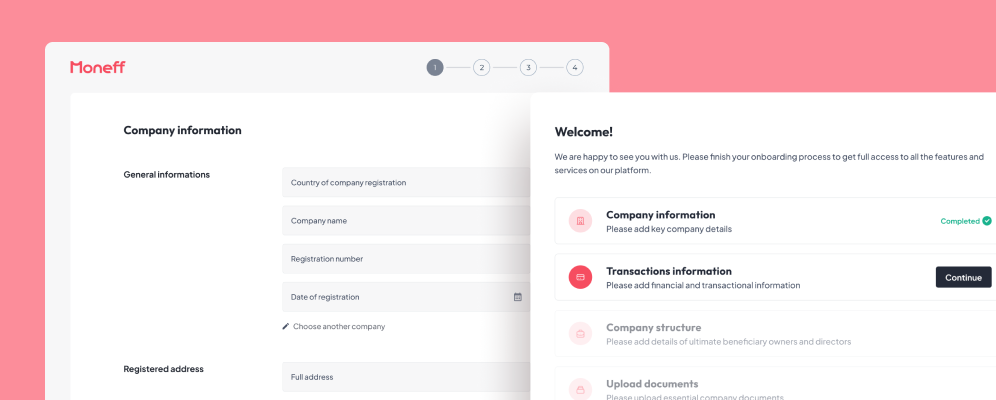

High-Fidelity design ideas

The final design

You can check out the final design prototype here: issue a card, card list, card details, and settings

Here is the physical card design in our customer’s hand

Final thoughts

- The product was launched for 50 customers for testing purposes.

- Customers issued 31 physical cards and 44 virtual cards.

- The customer satisfaction rate is 73%, which is good for a test launch.

- We got various suggestions and feedback from users. Added it to the ideas backlog.

- Prepared landing page for card activation

- For some reason, the project is still in test mode (Oct 2023).

What I would do differently

- Integrating with our Mastercard solution took around 1 year.

- We could have used existing services such as Modulr, Rapyd, Galileo, or Stripe for the MVP card solution.

- I would first develop the easy features we determined during interviews, and then I would integrate Mastercard.

A beautiful promo video prepared for marketing purposes