Customer onboarding. UK fintech startup

Onboarding a business account to our fintech product is a crucial stage where potential customers express their interest in our product. Our primary objective is to convert them into permanent customers. As a product designer, my challenge was to enhance the onboarding application form to deliver an optimal user experience (UX).

About company

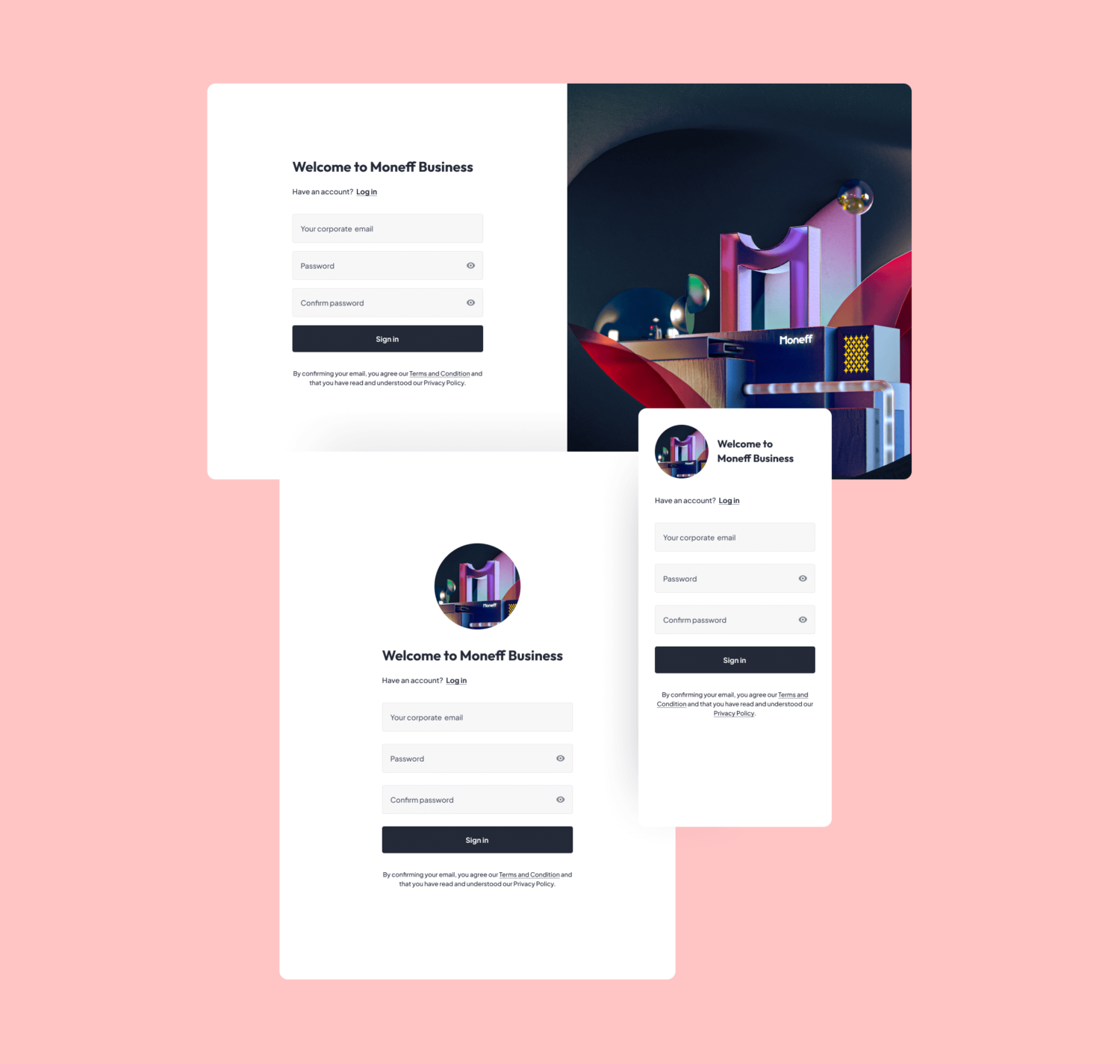

Moneff is a one-stop hub for small business owners. We enable SMEs and sole traders to move their money efficiently by offering free multi-currency business accounts (subject to eligibility), transfers with competitive FX rates, card issuing, and online payment processing services.

Lead Product Designer

Farkhod Saydullaev

Product Designer

Daria Zubarevich

Communication Manager

Gulnur Esova

UX Copywriter

Lala Cooper

Support Team Manager

Bobur Aykhodjaev

Compliance Officer

Nigora Mavlanova

Project Website

www.moneff.com

My role

I was the main initiator who pushed for the improvement of the account opening process. I led the project from end to end, collaborating with product owners, data analysts, UX writers, compliance, support departments, and developers to align constraints and their expectations. I delegated some parts of the UI design to a co-designer and handled the entire discovery step as we didn’t have a dedicated team for it.

Problem and Initial Assumption

- Customers are unhappy with the account opening time.

- Customers don’t know their application status after submitting it.

- The support team receives a lot of messages from customers regarding the application. It seems we can reduce them.

Discovery

Inside the company, problems related to business account onboarding were talked about a lot. With the team, we decided to improve the sign-up application and onboarding process.

- The support team is the product design department’s best friend for getting customer feedback.

- Conducted quality interviews with colleagues from support and compliance departments.

- Gathered team to figure out current onboarding problem

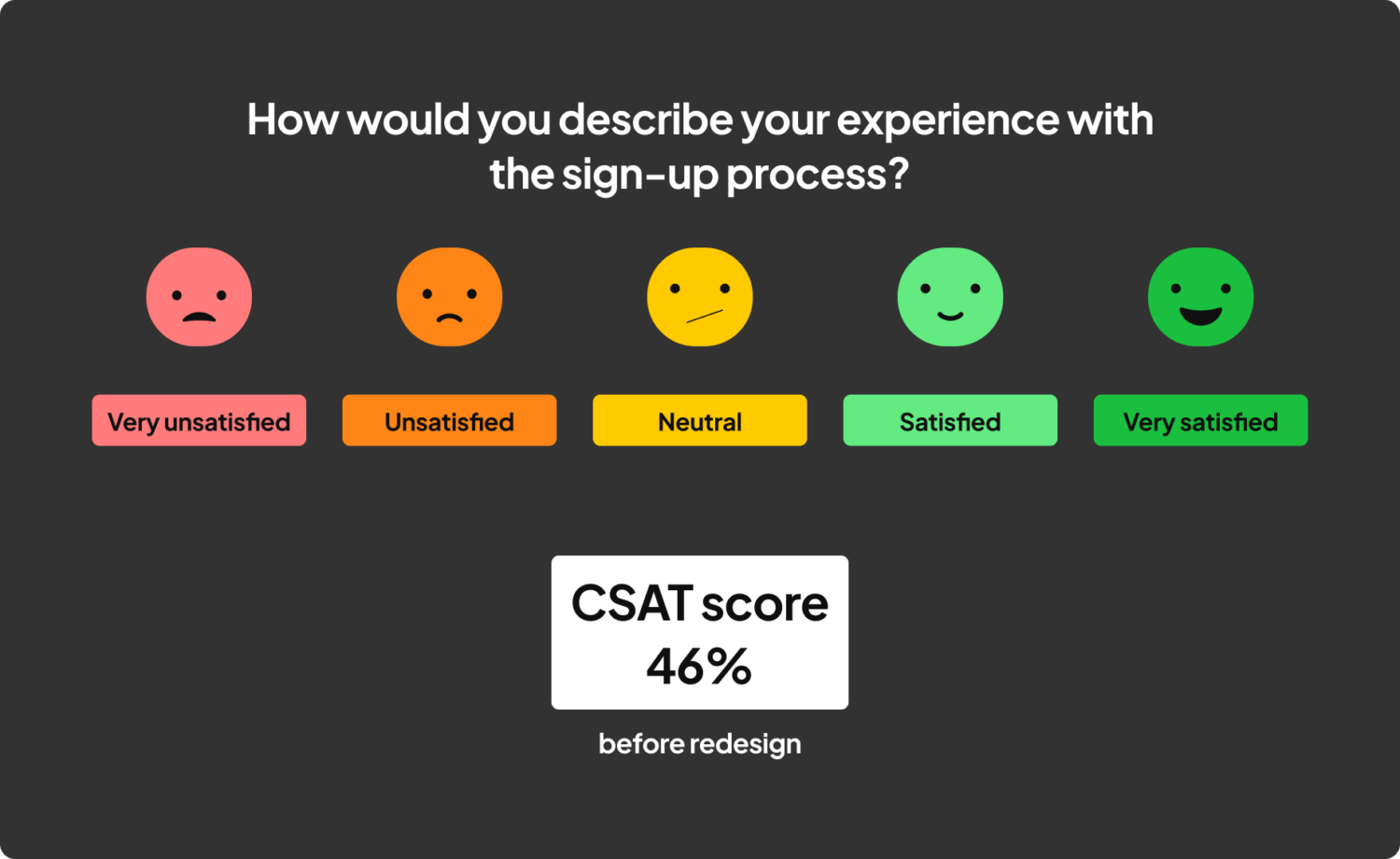

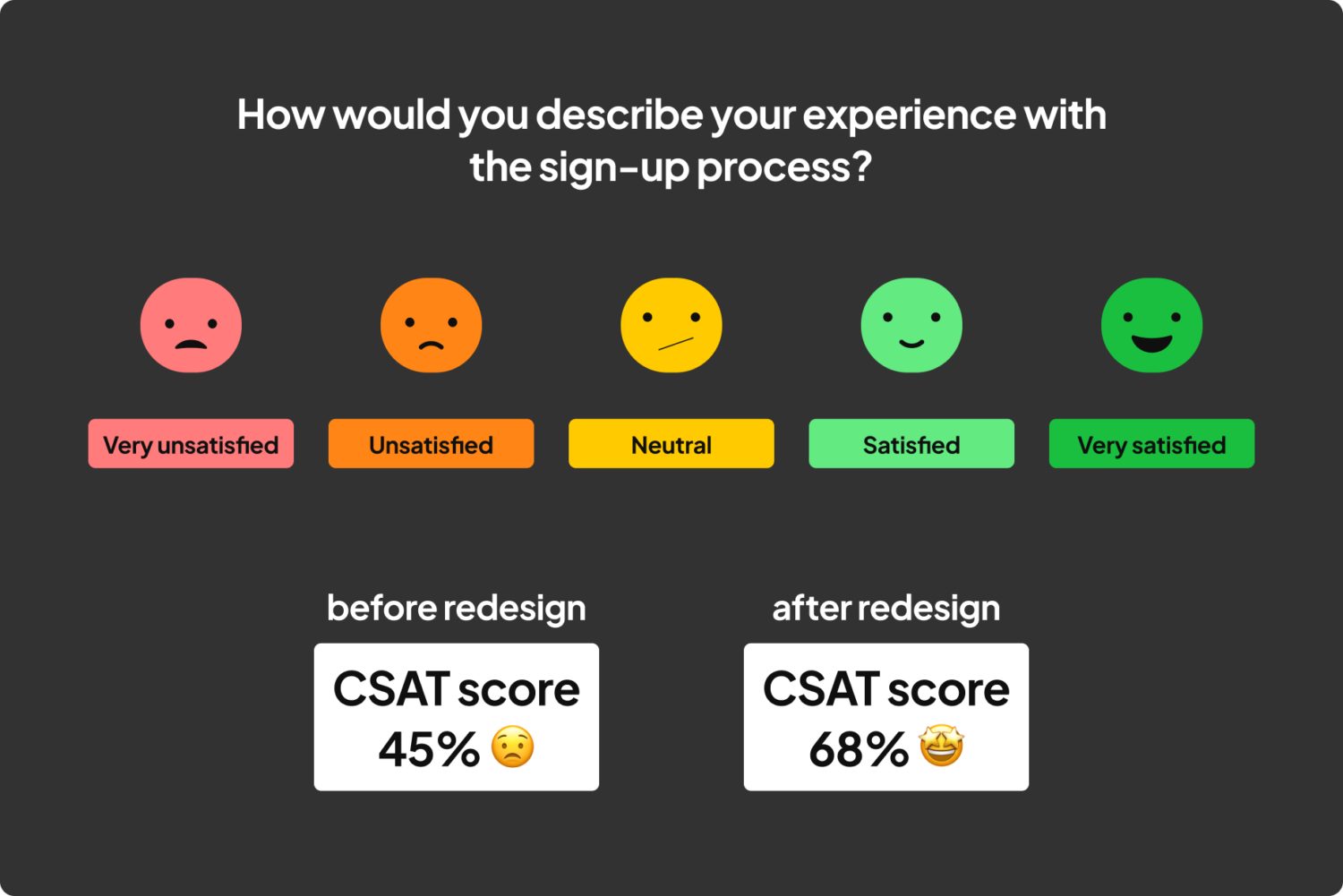

- Gauged CSAT before changes and it was 46% which is not good. Average CSAT index in the market is 77%.

CSAT (Customer satisfaction rate) before redesign

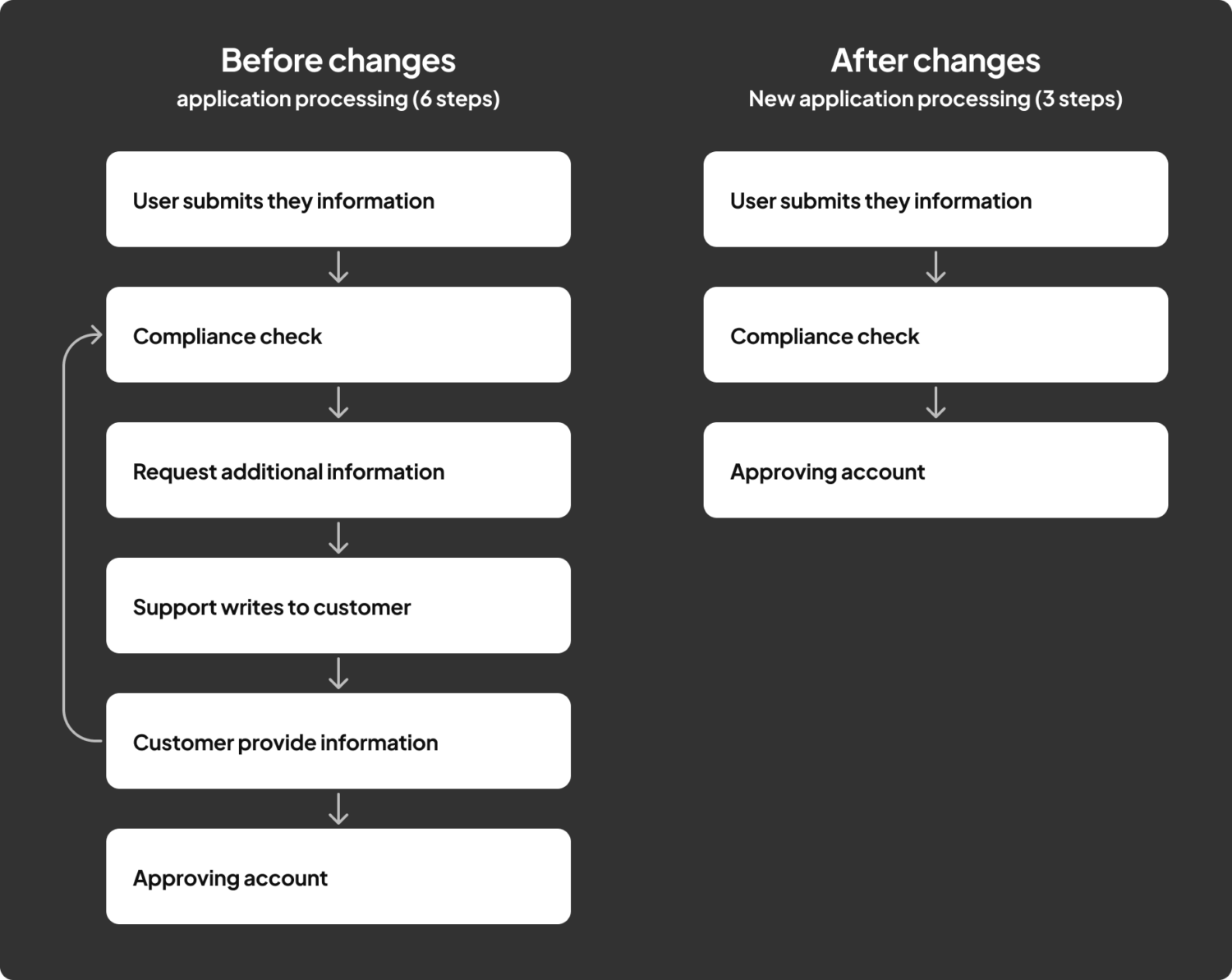

Comparing old and current sign up process

Workshop with team

Main findings

- The existing online sign-up application doesn’t meet compliance department requirements. They need more information from potential customers. Therefore, usually the compliance officer requests the support team get additional information from potential customers. It means account opening time increases.

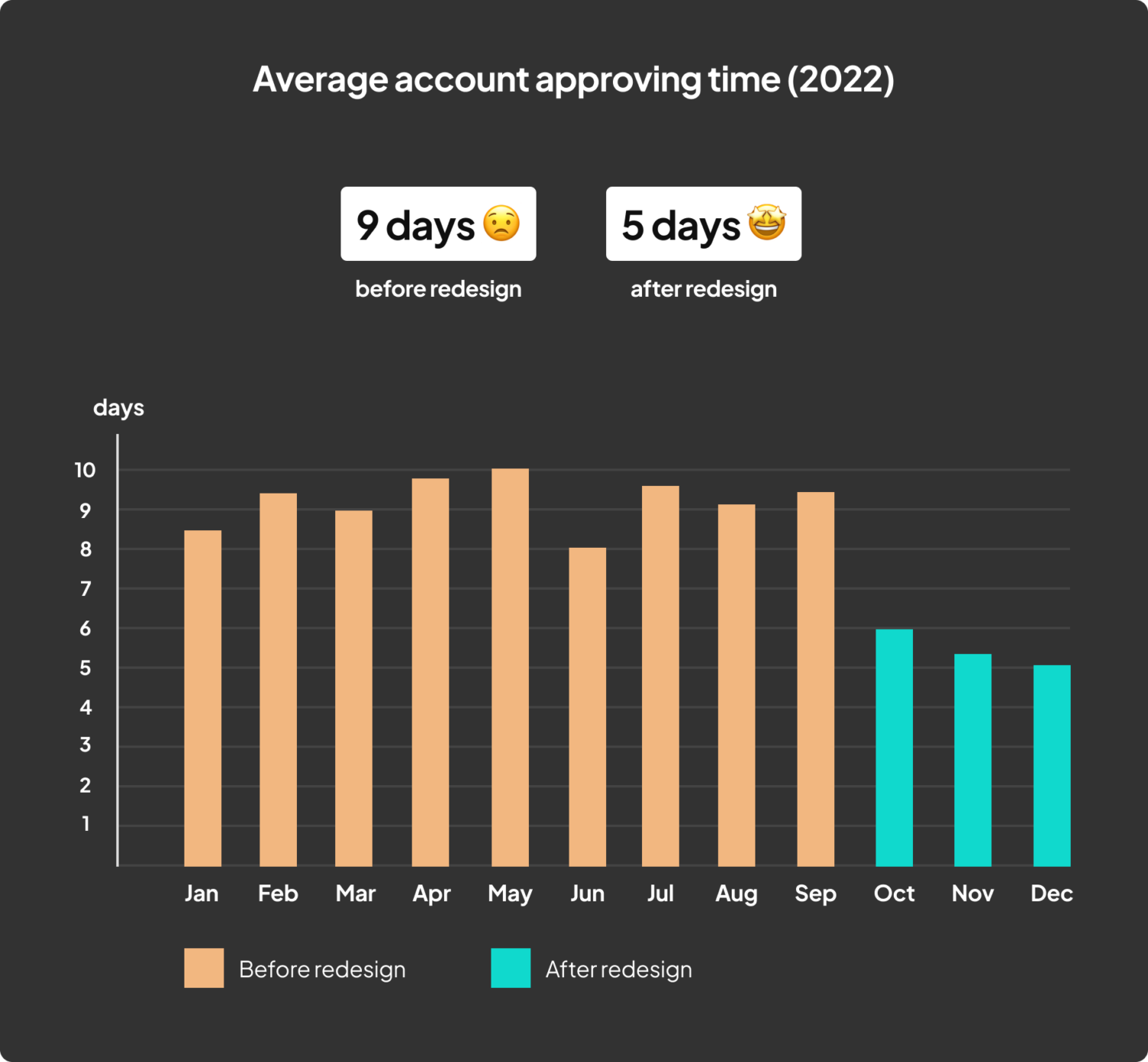

- The average time to open a business account was 10 working days. It is too long for neo-banks.

- Bank account opening in the United Kingdom – the government has a regulator called FCA. The regulator has a lot of requirements to open an account. You can’t open a bank account in the UK with the limited information which you get from customers.

- I saw the regulator’s requirements and I was a little bit shocked. We need to get from customers dozens of bit of information and it should be smoother for UX part. Yeah, it is a challenge.

- The existing online application was easy, hence many site visitors thought it was easy to open a bank account in the UK. About 60% of requests didn’t meet requirements and the team spent time processing and responding.

- Potential customers couldn’t find out about their application status. As a result the support team was overloaded with messages like ‘I would like to know my application status.’

- CSAT 46% which is too low.

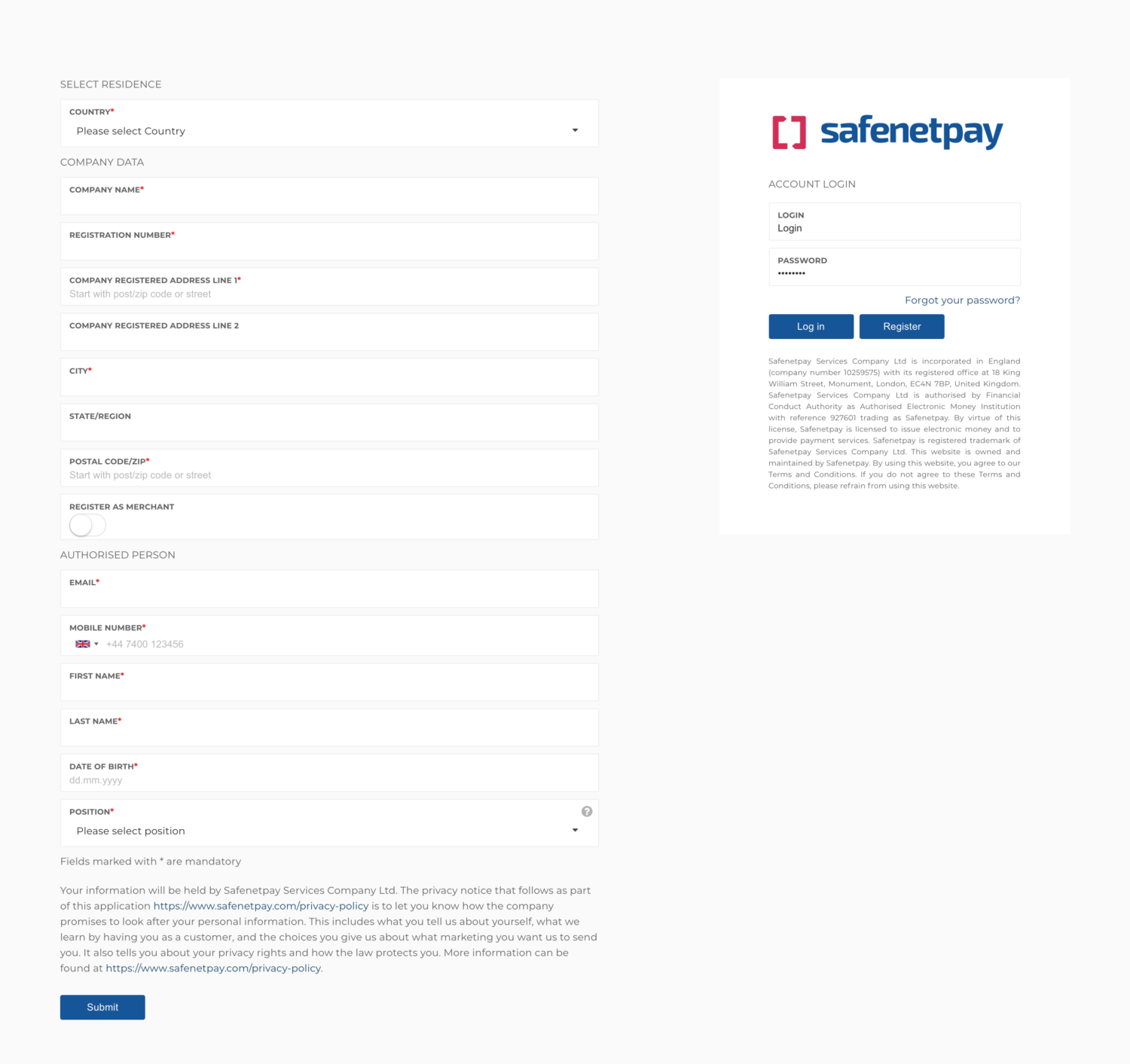

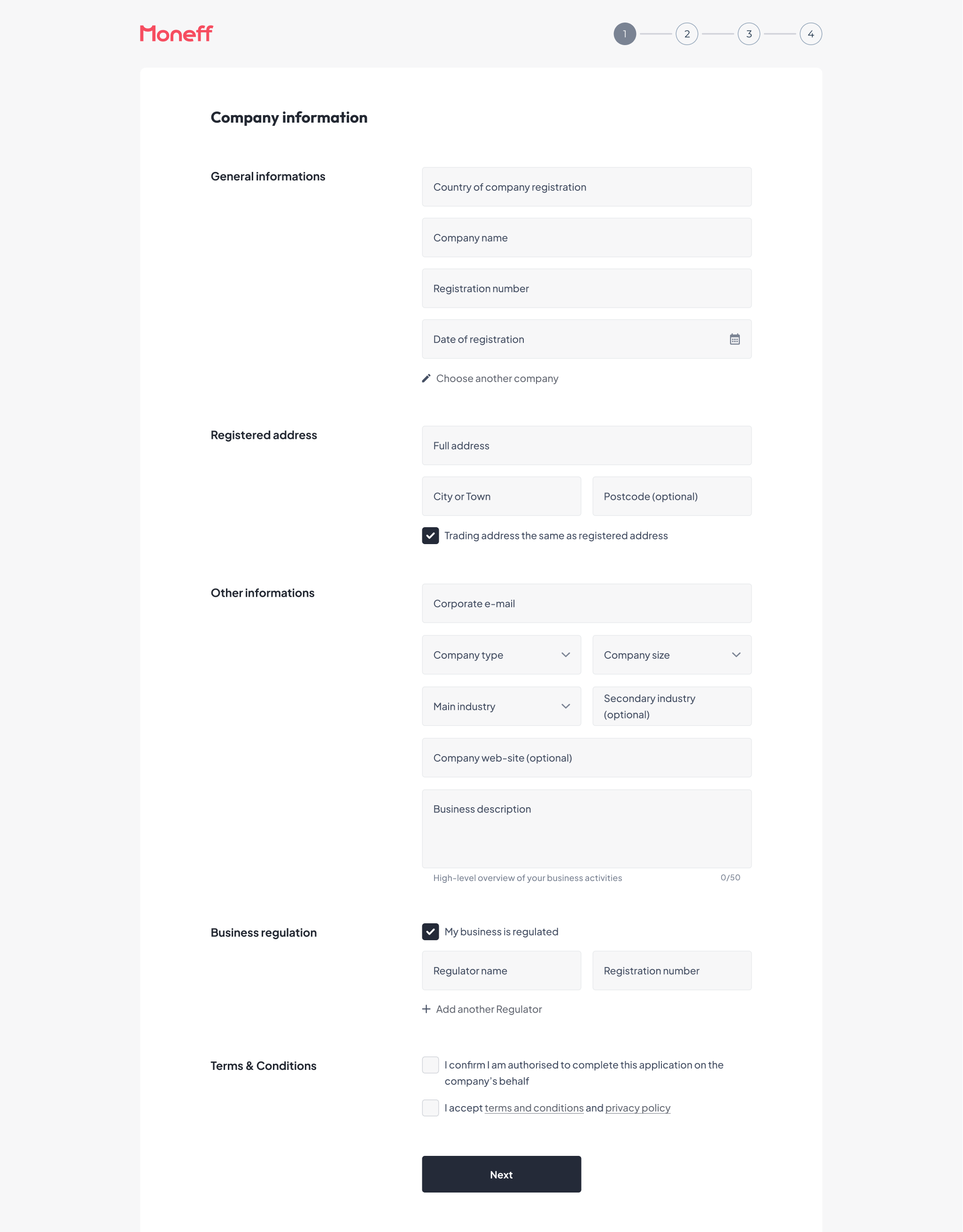

A previous version of the sign up process. Since October 2022, Safenetpay has been Moneff.

Goals after research

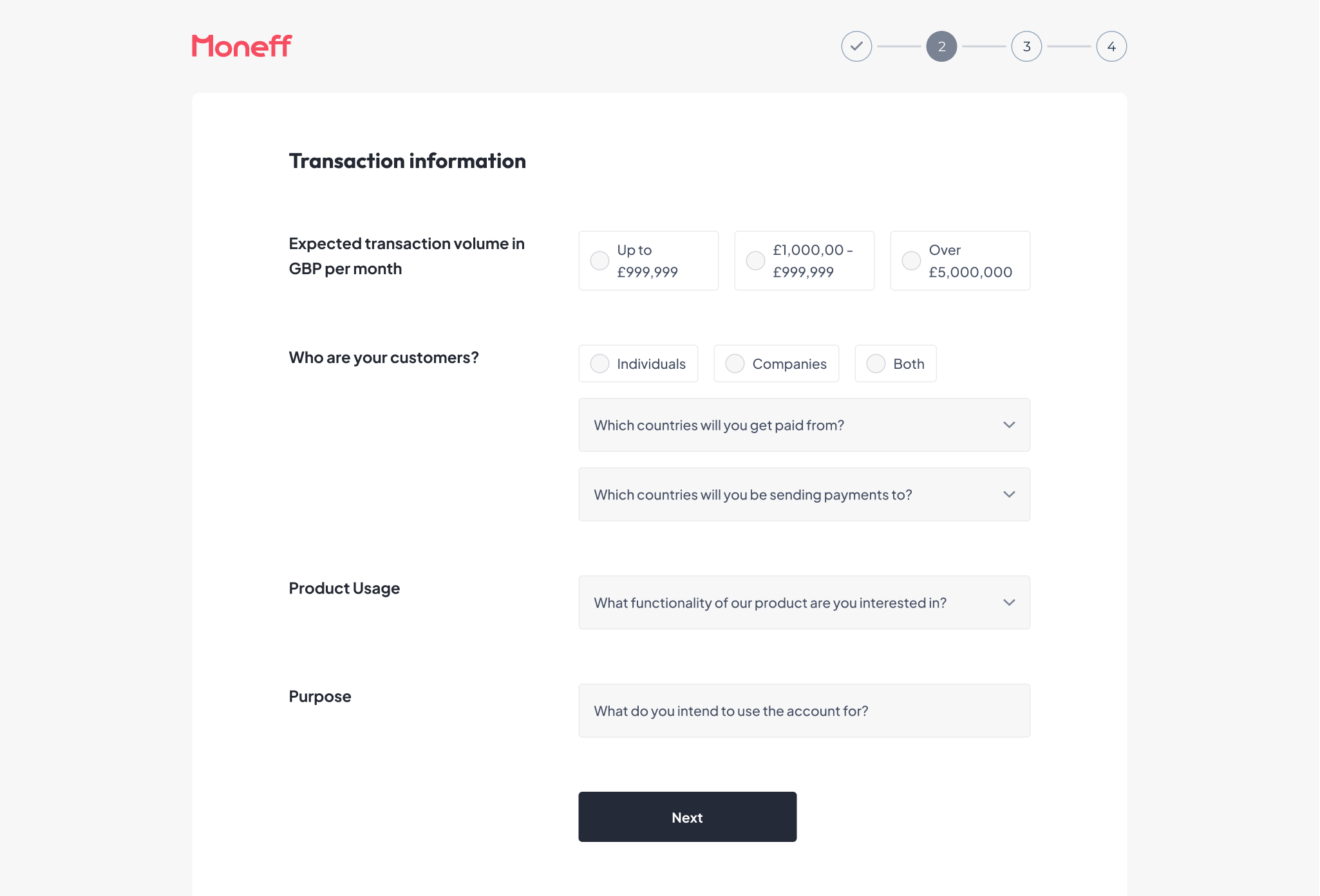

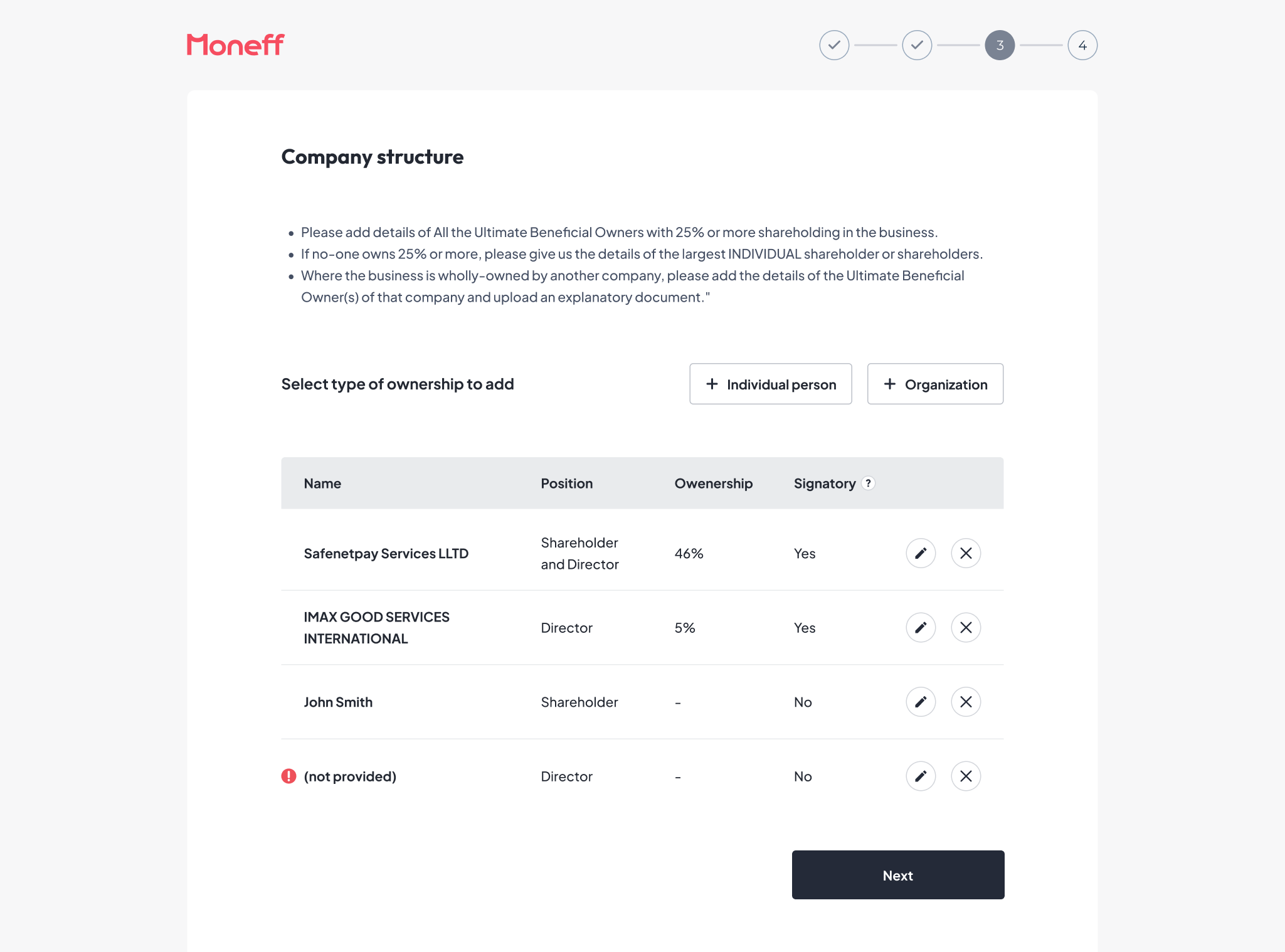

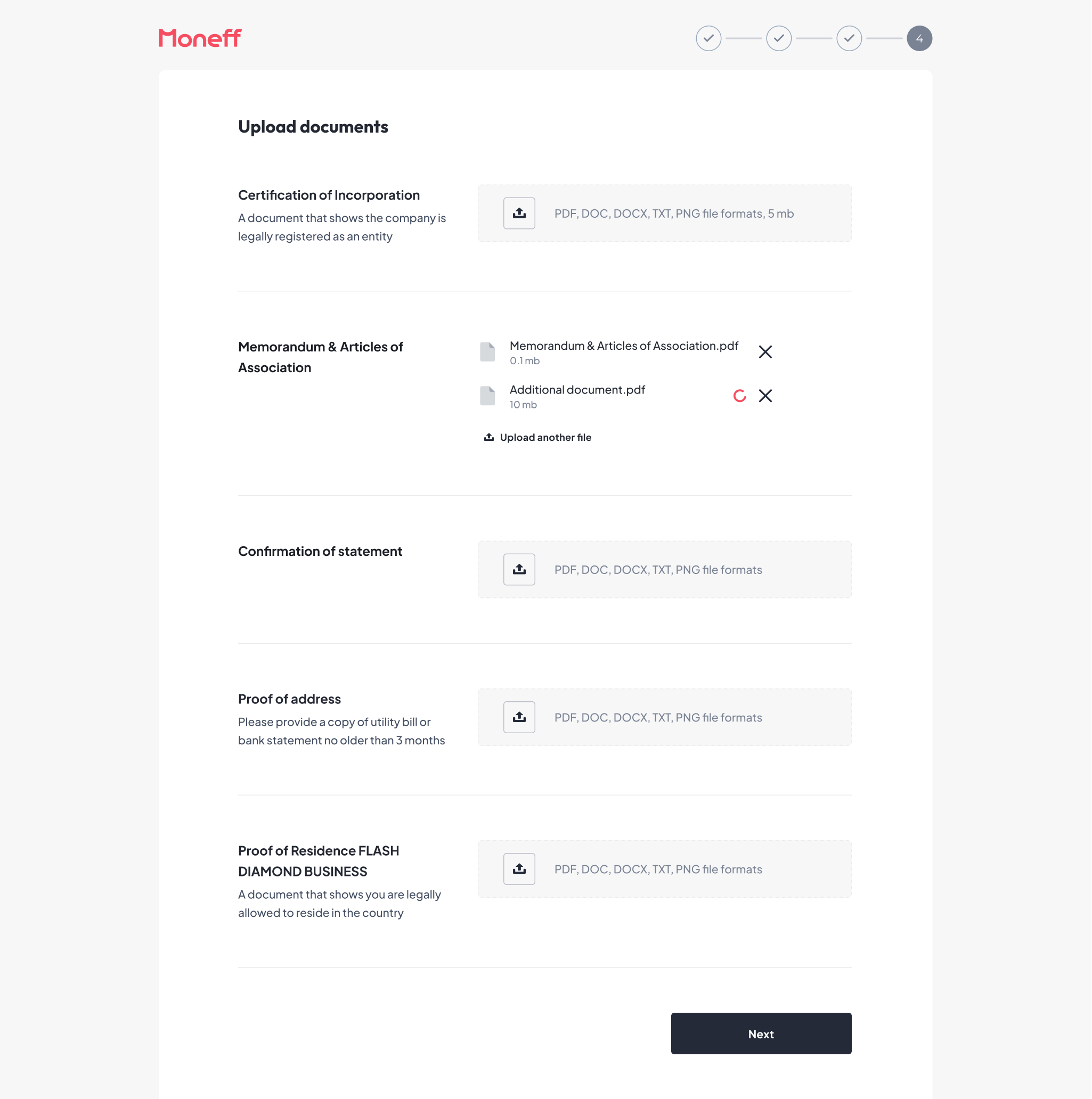

- Obtain additional information required by the UK FCA regulator from potential customers

- Provide information on account opening statuses

- Decrease the load on the compliance and support teams

- Improve the usability of the onboarding application

- Increase customer satisfaction rate

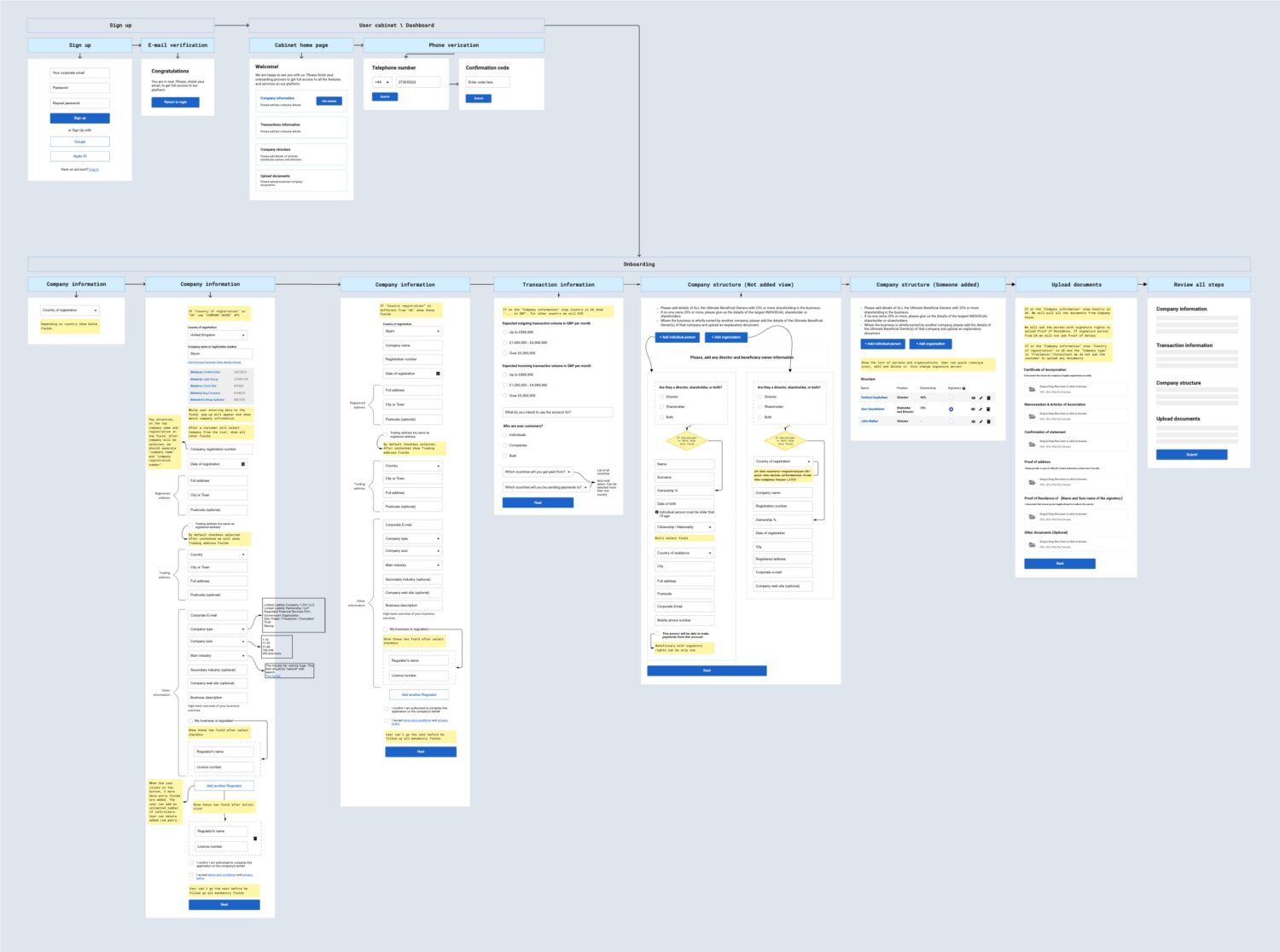

Low-fidelity wireframe

Plan to track the effectiveness of our solutions

After release, we plan to compare previous and new data with the help of our data analytics department.

- Compare the number of incoming messages sent to the support team.

- Count the number of accounts opened within a specified time interval.

- Measure the average account opening time from when a user submits their application to when the system sends an approval message.

- Check the customer satisfaction score (CSAT).

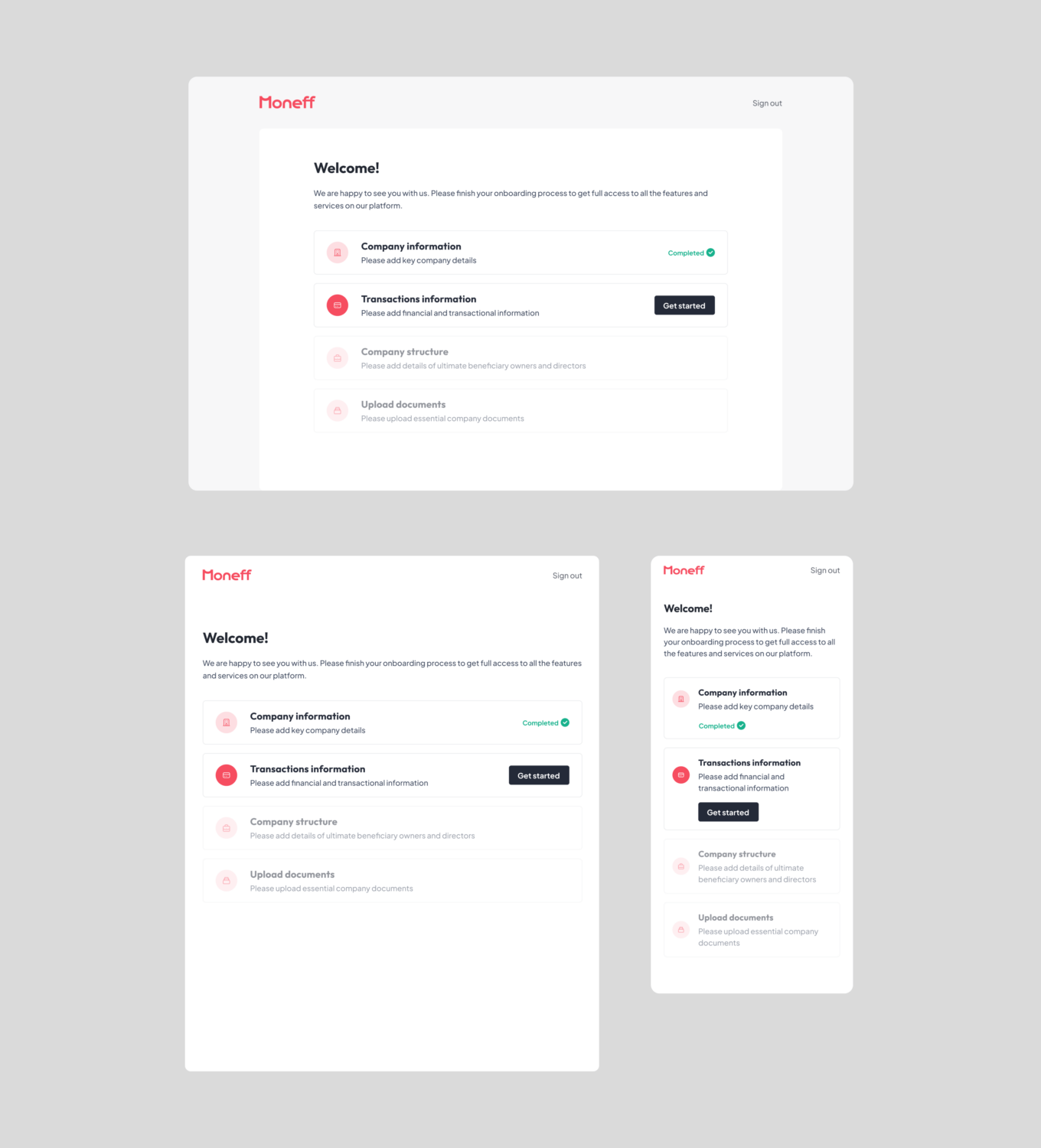

Solution

- Divided the onboarding form into steps to minimize cognitive load.

- Implemented automatic saving of each step’s information, allowing users to resume the sign-up process at their convenience.

- Enhanced the user interface to make it more user-friendly.

- Developed a mobile-responsive design for easy sign-up on mobile devices.

- Enabled users to check their application status through a simple sign-in process.

- Sent email notifications to keep users updated on their application status.

Success

- Average account approving time decreased from 9 days to 5 days.

- The compliance team’s workload has decreased. Now only 10% of applications fail to meet requirements, compared to 60% before the redesign.

- Before the design changes, the compliance team was planning to hire an assistant to help them with the application process. After the redesign, they changed their mind because the workload decreased, saving the company money.

- Fewer messages are now being sent to the support team inbox. For example, before the redesign, there were 50 messages per week related to application statuses and sign-up processes. Now, there are only around 10. The support team is happy with the decrease in workload.

- The number of approved accounts has increased by 10%, even though the compliance team now only processes 60% of the applications compared to before the redesign. This shows that the quality of incoming customers has increased.

- The CSAT score increased from 45 to 68, indicating an improvement in customer satisfaction.

Ideas for the future

- Integrate services like Company House or Orbis to automate gathering essential information about the customer’s business

- Identify and address the onboarding step with the highest abandonment rate.

- Conduct interviews with successful customers to gather insights for improvement.

- Investigate reasons for abandonment among users who do not complete the onboarding process.

- Divide each step into smaller, manageable tasks to decrease cognitive load.

- Consider offering an individualized approach for customers who desire it.